Brownfield Revolving Loan Fund

Piedmont Triangle RLF Coalition Brownfield Revolving Loan Fund

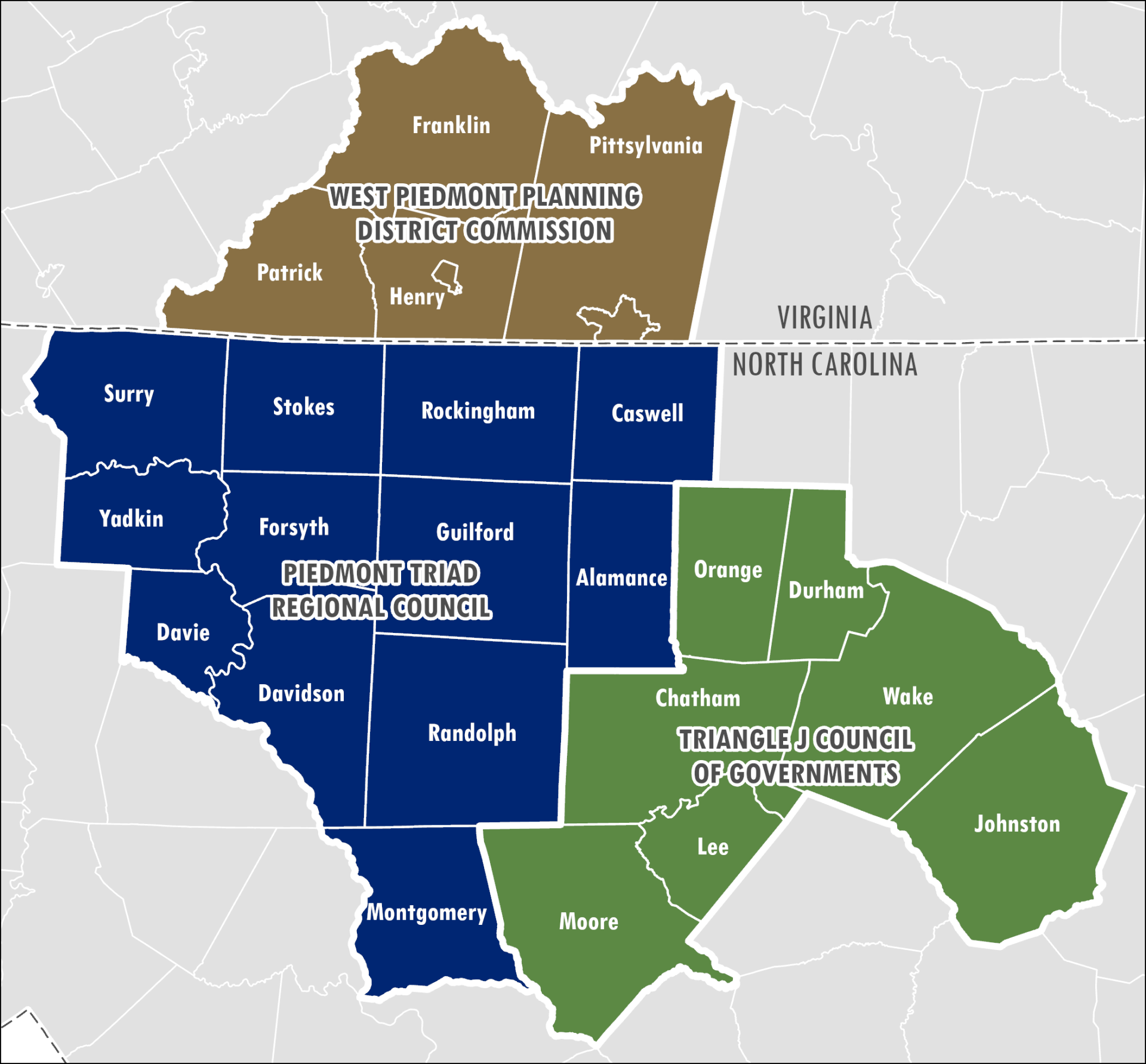

New in 2023, the Piedmont Triangle RLF Coalition Brownfield Revolving Loan Fund empowers communities in a 23-county area in North Carolina and Virginia to safely clean up and sustainably reuse brownfield sites. Funded with $1 million in grant funds from the EPA, loans and subgrants are available to help communities overcome the environmental, legal, and fiscal challenges associated with cleaning up contaminated brownfield properties.

What is a brownfield site?

Any real property for which the expansion, redevelopment, or reuse may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant. This can mean a vacant textile mill or a former furniture factory with suspected or confirmed hazardous material on the site.

We offer a guidance document with detailed information about this transformative opportunity. The 10 questions below highlight pertinent introductory information to form a picture of how the RLF Coalition can incentivize developers, local leaders and stakeholders to turn a contaminated site into a community and economic asset.

FAQs

1) What is an eligible brownfield site?

This is a question of eligibility per EPA criteria and site location. The geographic location must be within the three regional government areas comprising the Coalition:

- Piedmont Triad Regional Council, NC: Alamance; Caswell; Davidson; Davie; Forsyth; Guilford; Montgomery; Randolph; Rockingham; Stokes; Surry; and Yadkin counties including all municipalities.

- Triangle J Council of Governments, NC: Chatham; Durham; Johnston; Lee; Moore; Orange and Wake counties including all municipalities.

- West Piedmont Planning District, Va.: Franklin; Henry; Patrick; and Pittsylvania counties, including all towns as well as the cities of Danville and Martinsville.

The EPA defines a brownfield as: real property, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant (reference CERCLA § 101(39)). The Brownfields Law further defines the term to include a site that is, “contaminated by a controlled substance; contaminated by petroleum or a petroleum product excluded from the definition of ‘hazardous substance’; or mine-scarred land.”

2) Who can apply for a loan or subgrant?

For loans, a borrower can be an expanding business, local developer, national developer, nonprofit organization and public and quasi-public entities. The full range of applicant types and the specific regulation is in EPA’s FY23 FAQs document. In defining a nonprofit, the EPA follows the definition at 2 CFR § 200.1.

In general, the same definitions apply to subgrantees with an added stipulation that applicants must be the sole owner of the property that is the subject of a grant.

Two other eligibility restrictions apply as well:

- Borrowers and subgrantees are not eligible applicants if they are potentially liable for the contamination under CERCLA § 107.

- Any entity currently suspended, debarred from receiving federal funding, or otherwise declared ineligible cannot be a b0rrower.

3) How much money is available for loans and subgrants?

A balance of $1 million is immediately available. The RLF Coalition must use 50 percent or more of this balance for loans. Loans are provided for a minimum amount of $35,000 up to a maximum of available RLF loan capital. RLF programs often match subgrant assistance with RLF loans or other capital on at least a 1:1 ratio to offer subgrants to as many projects as possible.

Keep in mind subgrantees will be executing a grant with required reporting, record keeping and program requirements.

4) What is the interest rate on these loans?

In general, the interest rate will be less than or equal to the prime interest rate. Loan rates are anticipated to be between zero percent and the current market rate plus one hundred basis points.

The RLF Coalition’s Loan Committee will establish the rates per project, based on the ability of the borrower to support the debt service, and the overall risk of the project. The interest rate will be fixed for the term of the loan.

5) Is there a local cost share?

Yes. RLF borrowers and subgrant recipients must provide a minimum 20 percent local cost share. Local cost share expenses must qualify as eligible cleanup costs of the project and cannot include land value, ineligible construction, renovation or administration costs.

Borrowers and subgrant recipients may apply for a waiver of the cost share and such waiver may be granted by the RLF Coalition upon demonstration of hardship to the borrower and overriding public benefits that would result from the cleanup and redevelopment.

6) How long will it take to review and approve a loan or subgrant?

Depending on the complexity of the site and project, the process to review and approve a loan or subgrant application takes about 60-90 days.

7) Is there an application deadline?

The RLF Coalition accepts RLF applications year-round on a “first-come, first-served” basis for as long as the fund capital remains available.

8) How competitive is this process?

Keep in mind this is a discretionary program, but the probability of being funded is relatively strong provided that an application meets the eligibility requirements.

9) How is a revolving loan fund sustained?

A revolving loan fund is a capital fund that is used to provide loans or subgrants. When loans are repaid, the loan amount is returned into the fund and re-lent to other borrowers, providing an ongoing source of capital within a community.

10) Who reviews applications to the Piedmont Triangle RLF Coalition?

Two entities – the Brownfields Advisory Group and the RLF Loan Committee.

The Brownfields Advisory Group is comprised of 15 members (five from each region in the RLF Coalition) who review RLF applications and evaluates projects through the lens of financial, community, and economic benefit. Input from the public and from the Advisory Group informs the RLF Coalition recommendation for RLF assistance to the Loan Committee.

The Loan Committee is that in place for the Piedmont Triad Regional Development Council, and the committee serves as the RLF Fund Manager to provide program marketing and loan repayment services. This committee evaluates loan applications for basic financial soundness of the applicant and the proposed development project, as well as whether there is a reasonable likelihood that he borrower can repay the loan.

Contacts

Jesse Day

Regional Planning Director

(336) 904-0300

jday@ptrc.org